The winds of change are well and truly blowing, as…

Indian Textile Industry Is Set To Experience A Stunning Rise In The Next Two Years

Reports by rating firm Infomerics Valuation and Rating predict that the sector could grow to $300 billion by 2025-26, a growth of 300% in the next two years.

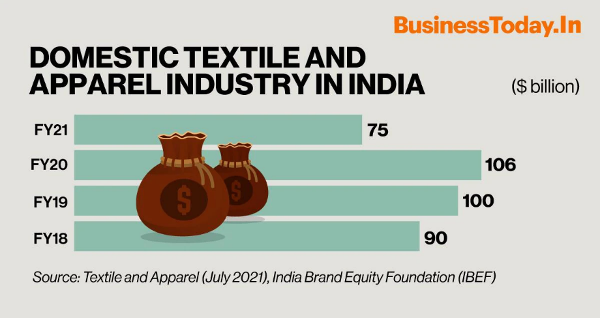

COVID-19 has significantly hit the Indian textile industry. However, the industry is leading the way towards recovery. After peaking at $106 billion in FY2020, the domestic textiles and apparels industry slumped to $75 billion during the pandemic. A government initiative to boost the sector has raised hopes that it will reach $300 billion by 2025-26, a growth of 300 percent in two years.

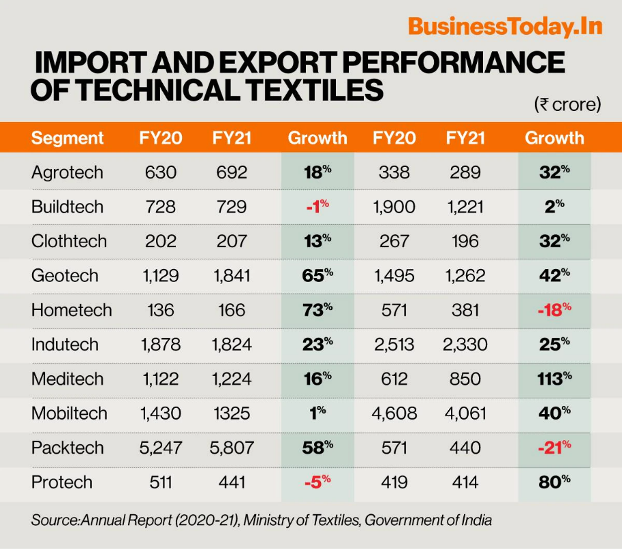

Technical textiles have experienced a remarkable turnaround. For FY20, technical textile imports were greater than exports by Rs 1,058 crore, while for FY21 exports were greater than imports by Rs 2,998 crore.

This report examines the factors that have affected the sector’s performance. And it says, apart from COVID-19, other factors causing bottlenecks for Indian exporters are its high tariffs in key markets, such as the European Union, and logistics.

Turnround in technical textiles

In FY21, India has transitioned from being a net importer of technical textiles (imports exceeded exports by Rs 1,058 crore) in FY20 to a net exporter of the same (exports exceeded imports by Rs 3,337 crore).

“In January 2019, 207 HSN Codes have been classified and notified as technical textiles with a view for ease of doing business,” it said.

The government had already approved the proposal to create the National Technical Textile Mission (NTTM) for a period of four years (2020-21 to 2023-24) with an outlay of Rs 1,480 crore.

It is expected that the market for technical textiles in India will increase 7.6 percent in the Asia-Pacific region in 2027 to reach $23.3 billion, up from $14 billion in 2020, states the report. Presently, Indian technical textiles account for approximately 8 percent of the global market.

The government has set a target to increase the export of technical textiles fivefold in three years, from the current $2 billion to $10 billion.

Other government interventions

Various government initiatives are also outlined in the report to help and bolster the sector. Historically, such initiatives include the Technology Mission on Cotton (TMC), the Technology Upgradation Fund Scheme (TUFS), and the Scheme for Integrated Textile Park (SITP). One recent measure is the National Technical Textiles Mission (NTTM) with an outlay of Rs 1480 crores for a period of four years (2020-21 to 2023-24).

There is a state-level action as well, with Tamil Nadu participating in Techtextil India 2021 – the world’s largest exhibition for technical textiles and non-wovens. It points out that this will open doors for innovation and reduce foreign dependence.

There are also measures to address the shortage of skilled workers in the textile sector, including the Scheme for Capacity Building in Textile Sector (SAMARTH), which aims to train 10 lakh people.

Challenges

- According to the report, a major problem for the textile industry is inadequate funding, with the Finance Ministry approving only Rs 3,631.64 crore for the textile ministry, as opposed to the planned outlay of Rs 16,883 crore.

- As a result, the industry has seen low manufacturing activity accompanied by high prices for the final product as measured by the NIC-2 digit and sectoral indices of industrial production, the latter of which has fallen below 100 for the first time in almost a decade.

- It has been approaching the 118-point mark in the yearly wholesale price index for ‘manufacturing of textiles’, which is 6-7 notches higher than the decadal average of approximately 112.

- Furthermore, the report observes that unorganised and small players are particularly affected by weakened consumer demand, the roll-out of GST, and the COVID-19 pandemic: obsolete technology, inflexible labour laws, inefficient infrastructure, and fragmented industry development.

- In particular, it highlights industry risk factors relating to the GST issue, the gap between the amount proposed and the amount approved, low performance and high prices, and poor performance of textile machinery.

What lies ahead

As the report points out, the industry needs to command premium prices, target niche markets, and redesign products for higher value-added segments. It also needs to focus on regional and cluster subsidies, technology up-gradation and skill development subsidies for sustained development. Investment in value-added services, e.g., marketing, warehouse rentals, logistics, courier, other product fulfillment costs constitute a pre-requisite for the sector going to scale. However, the report is optimistic about the potential for growth and structural transformation of the textile industry.

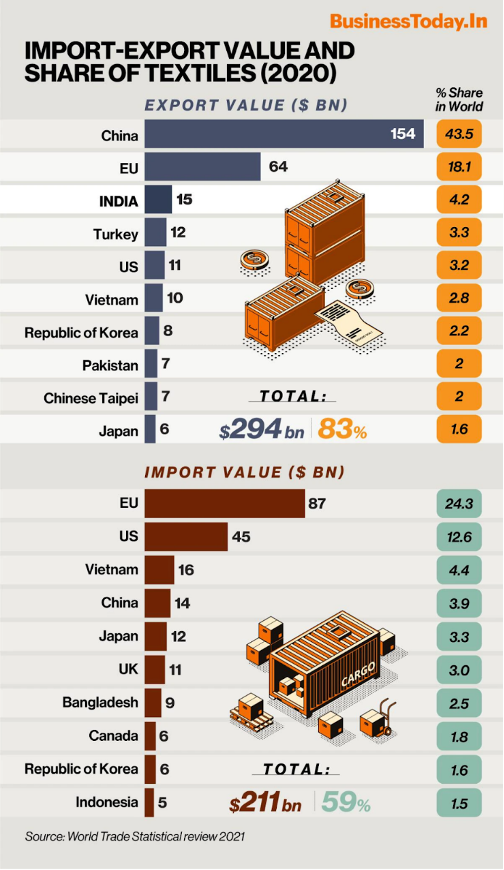

India’s textile industry is one of the largest in the world with an unmatched raw material base and manufacturing power across the value chain. It is the second-largest producer of man-made fibre (MMF) after China.

Moreover, the report points out that the industry must address the risk factors, the peculiarities of the sector, and the integration of the textile value chain for steady growth and consolidation of the Indian textile sector’s position in the comity of nations.

Passionate about transforming the industrial sector of textile and spinning industry with innovative solutions. Director at Jumac Manufacturing, leading spinning cans and accessories manufacturer and exporter from Kolkata, India.